We reside where money management is more difficult than money making. Keeping track of your finances is especially challenging for small business owners. Now, some of you might wonder how money management is complex for a small business owner. But let me tell you, they are the bosses plus employees plus managers for their businesses, unlike the established ones who hire whoever they want.

It’s not just about managing money; it’s about streamlining operations, saving time, and gaining a clear financial picture of your business. In 2025, the market is dominated by three powerful contenders: QuickBooks, Xero, and FreshBooks.

Each platform promises to simplify your finances, but is designed for different types of businesses.

QuickBooks Online: An Industry Standard

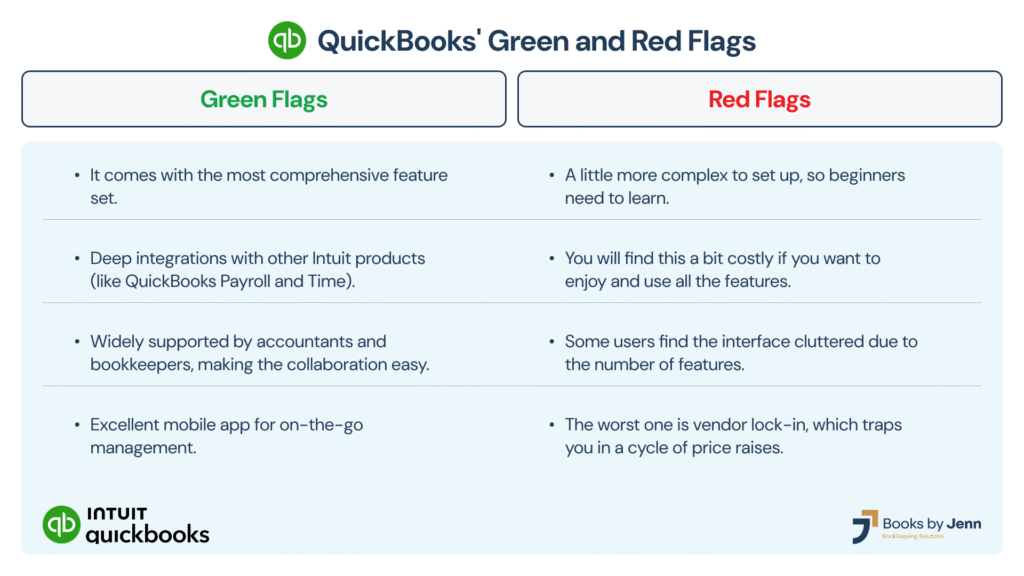

So, the first in the lane is QuickBooks, an industry leader from Intuit. It is the most widely used accounting software in the United States and is trusted by millions of businesses. QuickBooks is a comprehensive, scalable solution for small—to medium-sized businesses of all types, from product-based companies to service providers.

QuickBooks for small businesses is renowned for its robust feature set covering every aspect of financial management. Its key strengths lie in its deep functionality, particularly payroll, inventory, and detailed financial reporting. So, we have listed some key features for you to reflect on.

Key Features

- Detailed Reporting: With almost 80 customizable reports, this tool gives you granular insights into your business’s profitability, cash flow, and spending.

- Inventory Management: So, the other feature is crucial, as many competitors lack it. This keeps the real-time inventory tracks, manages costs, and handles purchase orders.

- Payroll: Seamlessly integrates with its own payroll service, allowing you to pay employees, manage benefits, and file taxes directly within the platform.

- Scalability: If your plans range from Simple Start to Advanced, QuickBooks can grow with your business, supporting a team of up to 25 users.

- AI-Powered Insights: Another flag it holds is the latest feature for 2025, which includes AI-driven agents that automate tasks like expense categorization and send proactive insights about your financial health.

Let’s have a sneak peek at QuickBooks’ green and red flags.

Xero: The Modern, Collaborative Solution

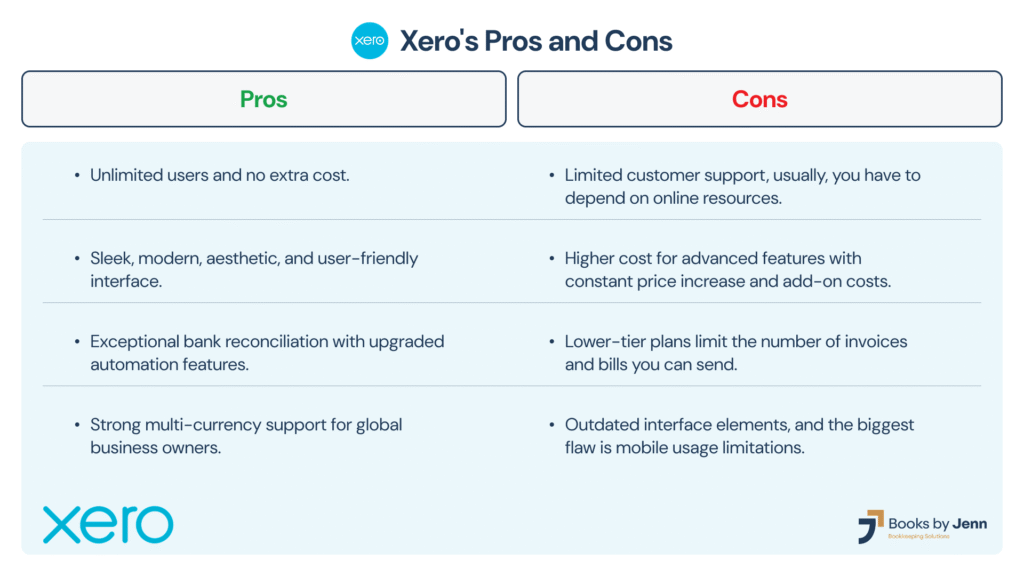

Now, let’s see what Xero has for us. Hailing from New Zealand, Xero established itself as a global player with a strong following, particularly in the UK and Australia. Its strength lies in its modern design, intuitive user interface, and focus on collaboration.

Xero is your perfect partner when you want to work together seamlessly on your finances. Xero for small businesses is known for its finest, easy-to-read dashboard and automation tools that simplify bank reconciliation and bill payments.

Main Features

- Unlimited Users: This is the hot-selling point, as Xero gives you freedom and unlimited users on all its plans without any extra fees, making it a perfect platform for collaborative teams.

- Effortless Bank Reconciliation: If you want to save time, this is the best option because Xero automatically pulls in bank transactions. It uses intelligent matching to suggest reconciliation, which means you have plenty of time for your other tasks.

- Global Focus: Okay, who is not interested in global-level influence? If you are among them, give me a high five because this platform supports multi-currency invoicing and transactions, making it ideal for businesses with international clients or vendors.

- Integration Ecosystem: It will boast a massive library of over 1,000 integrations with apps for e-commerce, CRM, inventory, and more.

- Project Tracking: Your go-to helper for managing project profitability by tracking time and costs against projects is here.

Let’s have a little comparison of the Pros & Cons so you can avoid them.

FreshBooks: Your Service Business Champion

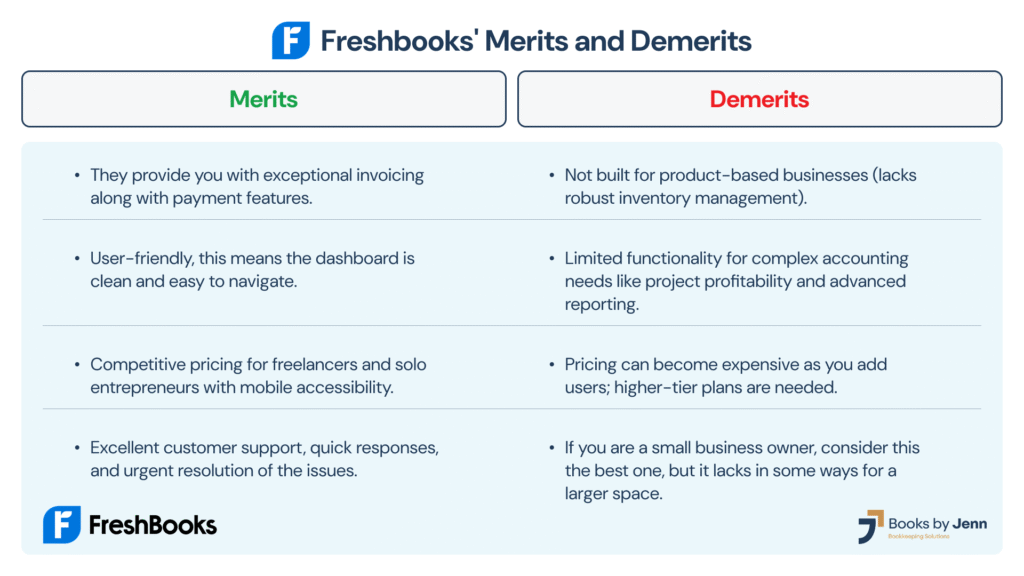

FreshBooks, a simple yet powerful invoicing tool that has evolved into a full-fledged accounting platform. However, its roots remain the same, but it’s still the top choice for freelancers, independent contractors, and small service businesses.

FreshBooks for a service business excels at client-facing tasks. This platform is built to simplify everything from time tracking to managing it, invoicing, and getting paid quickly.

Key Features

- Top-Tier Invoicing: Here comes the first feature: an invoicing system that is widely considered the best in the business. It is intuitive, highly customizable, and makes sending professional invoices a breeze.

- Time & Expense Tracking: I believe this feature of FreshBooks is the finest. A built-in timer that gives you the freedom to track billable hours with a single click and easily convert them into an invoice.

- Client Management: They facilitate your client management. By providing a dedicated client portal, you can help your clients view invoices, make payments, and they can even communicate with you. It makes them feel valued.

- Simple Reporting: People often leave platforms because of their complex structures, but FreshBooks makes things convenient for you. They offer straightforward, easy-to-understand reports like Profit and loss statements, sales tax summaries, and expense reports.

Here comes the merits and demerits of FreshBooks.

Head-to-Head Comparison 2025

Since we are done examining each platform’s features, merits, and demerits, let’s compare the most critical features side-by-side to see how they compare and decide what we, as small business owners, have to opt for.

Ease of Use

- FreshBooks: The clear winner. Why? Because its clean, intuitive interface is designed for simplicity and is perfect for users without accounting knowledge.

- Xero: It has a very strong, modern, visually appealing design that is easy to navigate with minimal learning curves.

- QuickBooks: Dominating but more complex. Its robust feature set makes the interface feel overwhelming for new users. However, it is logical and well-organized once you get the hang of it.

Invoicing & Payments

- FreshBooks: So, guys, the champion is here. Invoicing process: seamless, highly customizable, and includes swift payment reminders and client portals.

- QuickBooks: QuickBooks provides a wide range of customizable templates, but there is a sidekick. The process is not as streamlined as FreshBooks’. However, it does integrate seamlessly with QuickBooks Payments.

- Xero: Very good. Xero’s invoicing is clean plus efficient, focusing on automations and reminders. It also handles multi-currency invoicing within a blink.

Reporting

- QuickBooks: The undisputed leader. With over 80 reports and powerful customization options, QuickBooks gives you the most profound financial insights for business decisions.

- Xero: Good. Xero provides standard reports like Profit & Loss and Balance Sheet in a clean, professional format. Its reports are easy to understand but lack the depth of QuickBooks.

- FreshBooks: Basic but effective. The reports focus on service businesses’ needs, with a strong emphasis on income, expenses, and tax preparation.

The Final Verdict

Choose QuickBooks if… You are a small business owner, and your business is growing because all the features suit you. Inventory management, efficient payroll, in-depth financial reports, and many other features are set to scale your business.

Choose Xero if… You have a modern, collaborative team or international clients. Its aesthetic interface, unlimited user access, and strong bank reconciliation make it an excellent choice for businesses focused on efficiency and streamlined operations.

Choose FreshBooks if… You are a freelancer, consultant, or service business owner. If your primary needs are flawless invoicing, simple time tracking, and expense management, FreshBooks will save you the most time and headaches.