Running a small business is a whirlwind, isn’t it? You’re juggling a million things – serving customers, managing your team, developing new ideas – and somewhere in that mix, you know you need to keep your finances in order. But if you’ve ever felt a bit fuzzy on the difference between bookkeeping and accounting, you’re definitely not alone. It’s a common question, and understanding these two vital functions is key to your business’s financial health, especially as we navigate 2025.

Think of it like building a house. Bookkeeping is laying the foundation, meticulously placing each brick. Accounting is the architect who reviews the plans, ensures structural integrity, and designs for the future. Both are crucial, but they serve distinct purposes.

What Exactly is Bookkeeping?

At its heart, bookkeeping is the systematic recording of all financial transactions that happen in your business. It’s the day-to-day work, the detailed data entry that keeps your financial pulse accurate and up-to-date.

A bookkeeper’s main responsibilities include:

- Recording Transactions: Logging every sale, purchase, payment, and receipt.

- Managing Invoices: Handling accounts payable (what you owe) and accounts receivable (what’s owed to you).

- Reconciling Accounts: Making sure your bank and credit card statements match your internal records.

- Payroll Processing: Ensuring your team gets paid correctly and on time.

- Maintaining Ledgers: Keeping your financial accounts tidy and balanced.

40% of small business owners say bookkeeping and taxes are the worst part of running a business. So, essentially, a bookkeeper ensures that every penny is accounted for, creating a clear, reliable snapshot of where your money is going and where it’s coming from. They provide the raw, organized data that’s fundamental to everything else.

And What About Accounting?

If bookkeeping is recording the history, accounting is interpreting it and planning for the future. An accountant takes the meticulously organized data from the bookkeeper and transforms it into actionable insights.

An accountant’s role typically involves:

- Analyzing Financial Data: Diving deep into the numbers to spot trends, inefficiencies, and opportunities.

- Preparing Financial Statements: Creating crucial reports like your Income Statement (Profit & Loss), Balance Sheet, and Cash Flow Statement.

- Tax Planning & Preparation: Navigating complex tax laws to ensure compliance and identify potential savings – a big one for small business bookkeeping accounting!

- Financial Forecasting & Budgeting: Helping you plan for the future, set realistic goals, and make informed decisions.

- Strategic Advice: Providing guidance on everything from pricing strategies to growth opportunities based on your financial health.

An accountant is your financial advisor, helping you understand the “why” behind the numbers and guiding your business towards sustainable growth.

Bookkeeper vs. Accountant: The Core Differences

Here’s a quick rundown to clarify the roles:

| Feature | Bookkeeper | Accountant |

| Primary Focus | Recording daily transactions & organizing data | Analyzing data, interpreting, & advising |

| Scope | Historical data, day-to-day operations | Strategic overview, future planning |

| Tasks | Data entry, invoicing, reconciliation, payroll | Financial statements, tax prep, analysis, forecasting |

| Output | Organized records, basic reports | Strategic insights, complex reports, tax filings |

| Requirement | Often certification or experience | Usually a bachelor’s degree (CPA often preferred) |

Why Both Matter for Your Small Business Success?

For a thriving small business, it’s rarely an either/or situation. It’s about leveraging the strengths of both.

- Accuracy & Compliance: Good bookkeeping ensures your records are clean and ready for tax season. Without it, your accountant would spend valuable (and expensive) time cleaning up messy data instead of providing strategic value.

- Informed Decisions: Your accountant uses the bookkeeper’s data to give you a clear picture of your profitability, cash flow, and overall financial health. This insight is gold for making smart business moves.

- Growth & Planning: If you’re looking to expand, secure a loan, or simply understand where you stand, precise accounting for small businesses built on solid bookkeeping is indispensable.

Bookkeeping vs. Accounting in 2025

In 2025, the landscape for both bookkeeping and accounting continues its rapid evolution, largely driven by advancements in automation and cloud technology. For bookkeepers, this means a significant shift from purely manual data entry to a more supervisory and specialized role. Cloud-based accounting software, enhanced with AI and machine learning, now handles many repetitive tasks like transaction categorization from bank feeds, automated invoice matching, and even preliminary reconciliation.

This frees up bookkeepers to focus on ensuring data integrity, identifying and resolving discrepancies that automation might miss, and providing accurate, real-time foundational data. They’re becoming the crucial guardians of your financial data’s initial quality, ensuring the digital ‘bricks’ are perfectly laid.

Meanwhile, this precise and readily available data elevates the role of the accountant even further. With less time spent on data cleanup, accountants in 2025 can fully leverage sophisticated analytical tools, predictive modeling, and even AI-powered insights to offer truly proactive financial guidance.

They’re moving beyond historical reporting to deep-dive analysis of trends, sophisticated tax planning tailored to evolving regulations, strategic forecasting for expansion or market shifts, and providing invaluable advisory services. The synergy is clearer than ever: the bookkeeper ensures the bedrock of clean, real-time data, enabling the accountant to act as your strategic financial architect, guiding your business with precision towards its future goals.

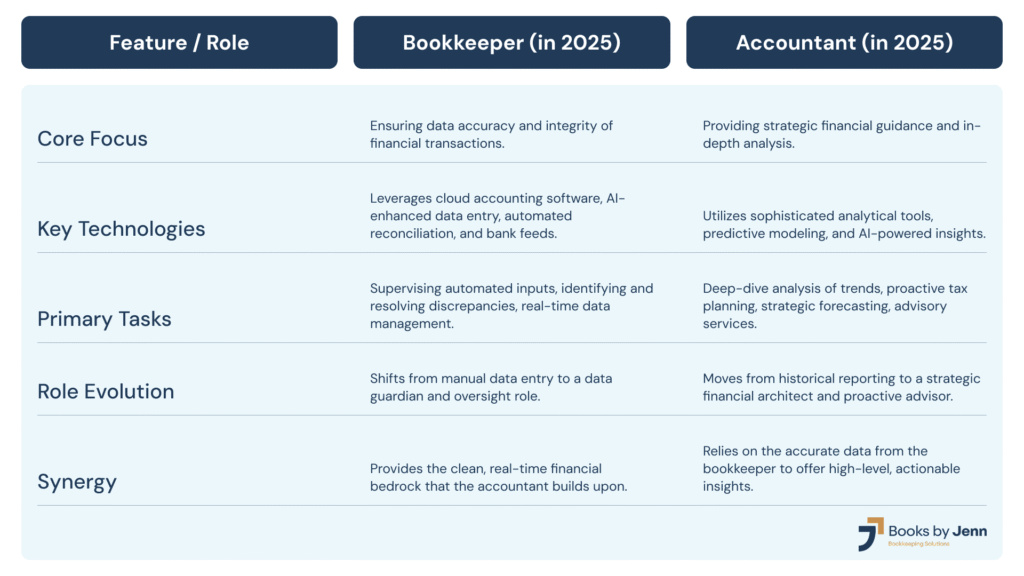

To give you an even clearer picture of these distinct yet collaborative roles in the modern financial landscape, here’s a quick breakdown:

Ready to Simplify Your Finances?

Navigating the complexities of small business bookkeeping and accounting can feel overwhelming, but it doesn’t have to be. Whether you need meticulous daily record-keeping, expert financial analysis, or comprehensive payroll management, having the right financial partner makes all the difference.

At BooksByJenn, we understand the unique needs of small businesses. We’re here to take the financial burden off your shoulders, giving you accurate records, clear insights, and most importantly, peace of mind. Let us handle the numbers so you can focus on what you do best: running and growing your business.